Can you send cash to your own Venmo account? Uncover the secrets of self-sending and unlock a world of financial convenience and fun.

Venmo is a mobile payment app that lets users send and receive money from family and friends easily. The app simplifies financial transactions, making it convenient for splitting bills, sharing expenses, and making payments. However, you might wonder if it is possible to send money to yourself on Venmo and why you would want to do so. In this article, we learn how Venmo works, whether self-transfers are allowed, and alternative methods for self-funding.

Understanding Venmo and How it Works

Venmo functions as a mobile payment service owned by PayPal. Imagine having your bank accounts and credit cards in your pocket, ready for action. So, here is how this magic works: You link your bank or card to Venmo, just like adding your favorite songs to a playlist. Once they are connected, you can do some pretty nifty stuff. Got a buddy who owes you for dinner? Want to split the rent with your roommates? Venmo has got your back.

Effortlessly send money to family and friends with a few taps. You can even add notes or cute emojis to jazz up your transactions. But wait, there is more! Venmo isn't just about sending cash between family and friends; it also allows you to pay for your goodies. Venmo is like your trusty digital wallet that makes spending money and paying for stuff easy.

Is It Possible To Transfer Funds Into Your Own Venmo Account?

It is possible to send money to yourself on Venmo, but not directly. Venmo is a peer-to-peer payment app, meaning that it is designed for sending and receiving money from other people. Here are the three methods to Venmo yourself:

1. Using a Venmo Debit Card

Step 1: If you don’t have one, you will need to apply for a Venmo Debit Card through the Venmo app.

Step 2: Ensure your bank account is linked to your Venmo account. This is where money will come from to load onto your Venmo Debit Card.

Step 3: Open your Venmo app and sign into your account.

Step 4: Select the ‘Cards' tab located at the bottom of the screen.

Step 5: Tap ‘Manage Balance’

Step 6: Tap ‘Add Money’

Step 7: Enter the amount of money you want to transfer, select your Venmo Debit Card, and tap ‘Add.'

Once the money is in your Venmo balance, you can use it to load your Venmo Debit Card. This card can be used for purchases like any other Debit card.

2. Using a Second Venmo Account

Step 1: Create a second Venmo account.

Step 2: Link a bank account or credit card to your second Venmo account.

Step 3: Log into your first Venmo account and send money to your second Venmo account.

Step 4: Log into your second Venmo account and send money back to your first Venmo account.

Venmo does not allow users to have multiple accounts. If Venmo discovers that you have multiple accounts, your accounts could be suspended or banned.

3. Using a Check or Credit Card

Using a check:

Step 1: Write a check to yourself and deposit it into your Venmo account.

Step 2: If you want to deposit a check into your Venmo account, take a photo of the check and upload it to the Venmo app.

Step 3: It may take up to 3 business days for the check to clear and the money to appear in your Venmo balance.

Using a credit card:

Step 1: Charge your credit card to your Venmo account.

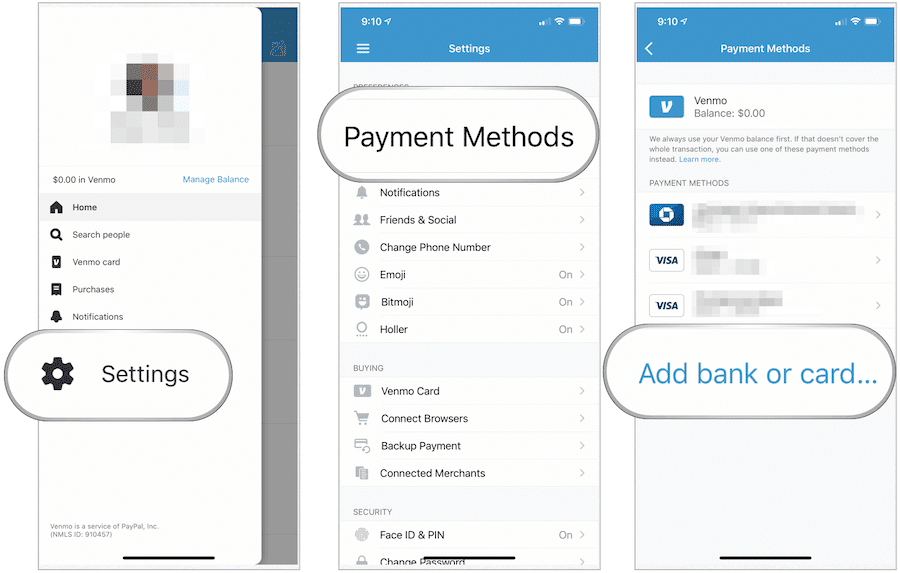

Step 2: To charge your credit card to your Venmo account, go to ‘Settings' and tap ‘Payments Methods.'

Step 3: Select ‘Add a Credit or Debit Card' and enter your credit card information.

Step 4: Once your credit card has been added, you can use it to add money to your Venmo balance.

Step 5: There may be a fee associated with adding money to your Venmo balance using a credit card.

Reasons You Might Want to Venmo Yourself

- Suppose you paid for something with your own money on behalf of a group, you can Venmo yourself to get your share back.

- You can Venmo yourself to help see how much you’ve spent on personal stuff, allowing you to do your budget better.

- You may want to shift money between your accounts.

- You might want to check if your Venmo account is working by sending a small amount to yourself.

- Having a stash of cash in Venmo can be handy for unexpected expenses.

- It is simpler to use Venmo for personal transactions, especially if you like to pay with your phone.

Risks and Limitations of Venmoing Yourself

Using Venmo to send money to yourself comes with a few things to be careful about:

- Fees. Sometimes, there are charges for moving money around. Make sure you know if there are any fees.

- Safety Concerns: if you are using a third-party service to Venmo yourself, there is a risk that your account could be hacked. It is important to choose a reputable third-party service and to enable strong security features, such as two-factor authentication.

- Venmo’s terms of Service. Venmo prohibits users from sending money to themselves. If Venmo gets to know that you often Venmo yourself, your account could be suspended or banned.

Is it worth Venmoing Yourself?

Venmo can be useful in specific situations, but it is important to weigh the benefits against potential drawbacks and adhere to Venmo's policies. If you are unsure about it, consider alternative methods or consult with a financial advisor to determine the best approach to your financial needs.

What are the best Alternatives to Venmo yourself?

The best alternatives to Venmoing yourself depend on your individual needs and circumstances. Here are a few alternatives you might consider:

- Use another Payment App. Instead of Venmo, you can use other payment apps like PayPal, Cash App, or Zelle to transfer money between your accounts.

- Write a Check. Write a check to yourself and deposit it into your bank account.

- Use a Bank Account. You can transfer money between two different bank accounts using your bank's online or mobile banking app.

- Use a Money Order. Purchase a money order and make it payable to yourself, then deposit it into your bank account.

- Ask a Relative or Friend. If you have a trusted family member or friend, you can ask them to help you with the transfer.

FAQs

Q. Can you transfer money between PayPal and Venmo?

No, you cannot directly send money from PayPal to Venmo. To transfer funds between these two platforms, you need to move the money from PayPal to your linked bank account and then transfer it to Venmo.

Q. How long does it take for funds to reach your Venmo balance?

When you add money to your Venmo account, it takes 1-3 business days for the money to be available in your Venmo balance. However, the payment method you used, the time of the day, and which day may affect the period the funds reach your Venmo balance.

Q. Venmo Maximum Funding Limits?

There are limits to how much money you can add to your Venmo balance, depending on whether you have verified your identity on Venmo or not. If you have not verified your identity, you are allowed to add up to $299.9 per week and $4,999.99 per month to your Venmo balance. If you have verified your identity, you can add up to $6,999.99 per week and $19,999.99 per month to your Venmo balance.

Conclusion

Venmoing yourself can be a valuable tool for managing your finances with ease. However, it is important to stay alert and careful about potential fees, be cautious about security concerns, and respect Venmo's terms and policies to ensure your account remains in good standing. While Venmoing yourself offers practical solutions, it is always wise to consider your unique financial needs and explore alternatives if necessary. By using Venmo responsibly and staying informed about any charges and restrictions, you can make the most of this user-friendly platform for your personal financial goals. Do not hesitate to give it a try and experience the convenience of Venmoning yourself.